Easy to use payments file validation

Teams involved in payments need a quick and easy way to check bank payments files. They need to check the technical file format as well as conformance to bank-specific business rules.

The XMLdation Validator® is an easy to use Service for checking payments files. No training is needed, and it can be used as and when the need arises. The Validator works for hundreds of different variations of the payment file formats used at banks.

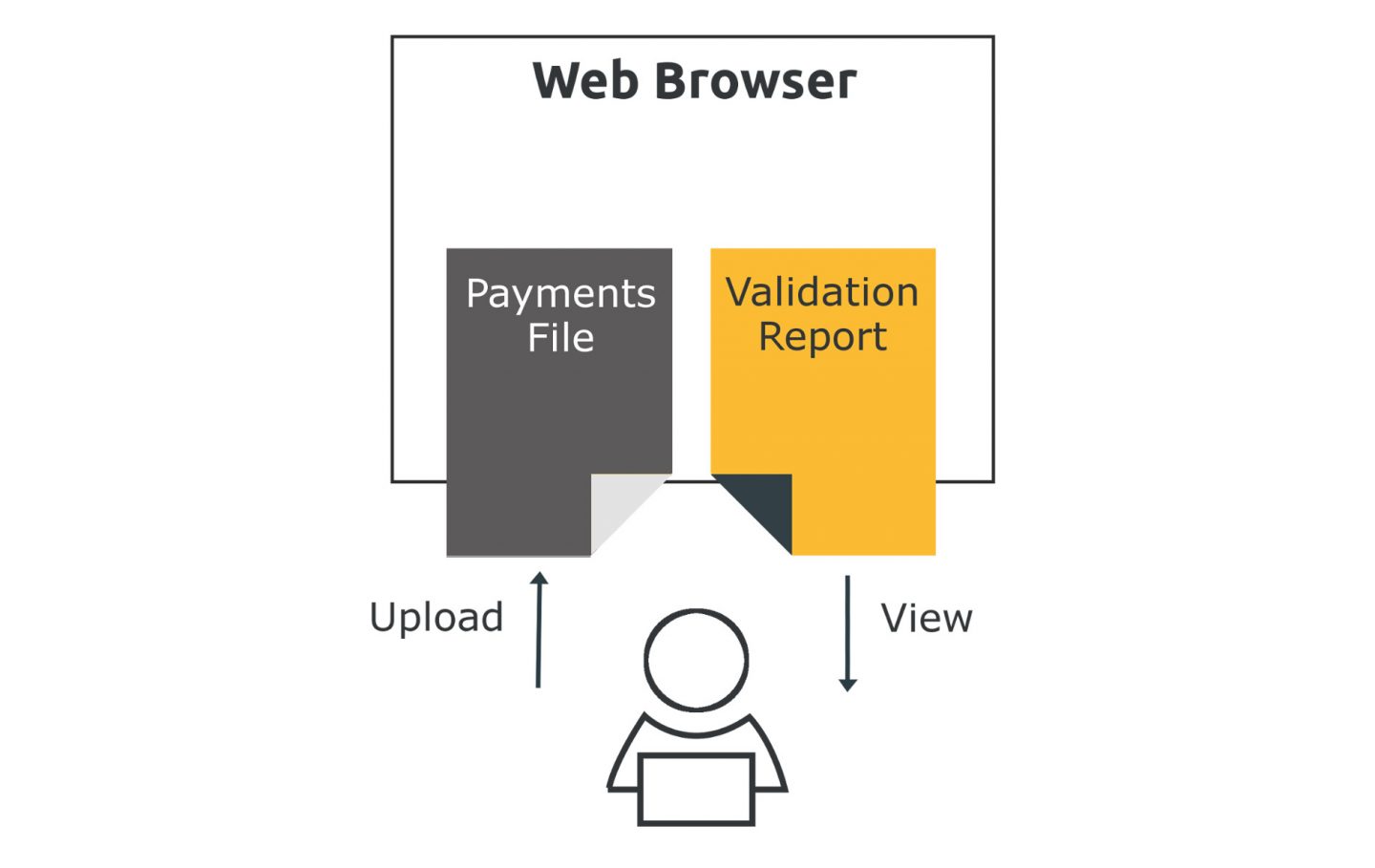

How the Validator® works?

The user logs into our Service in their browser. They upload the file to be validated and select the payment product and bank against which to validate. A detailed validation report is presented, with errors pinpointed.

File formats supported

The Validator supports all file formats. Our clients already use the Validator for a whole range of different payment file formats e.g.

- ISO 20022 XML

- SWIFT MT and MX

- Canadian EFT

- US ACH

- Proprietary XML, CSV, fixed length and other flat files.

The Validator is not limited to payments file formats.

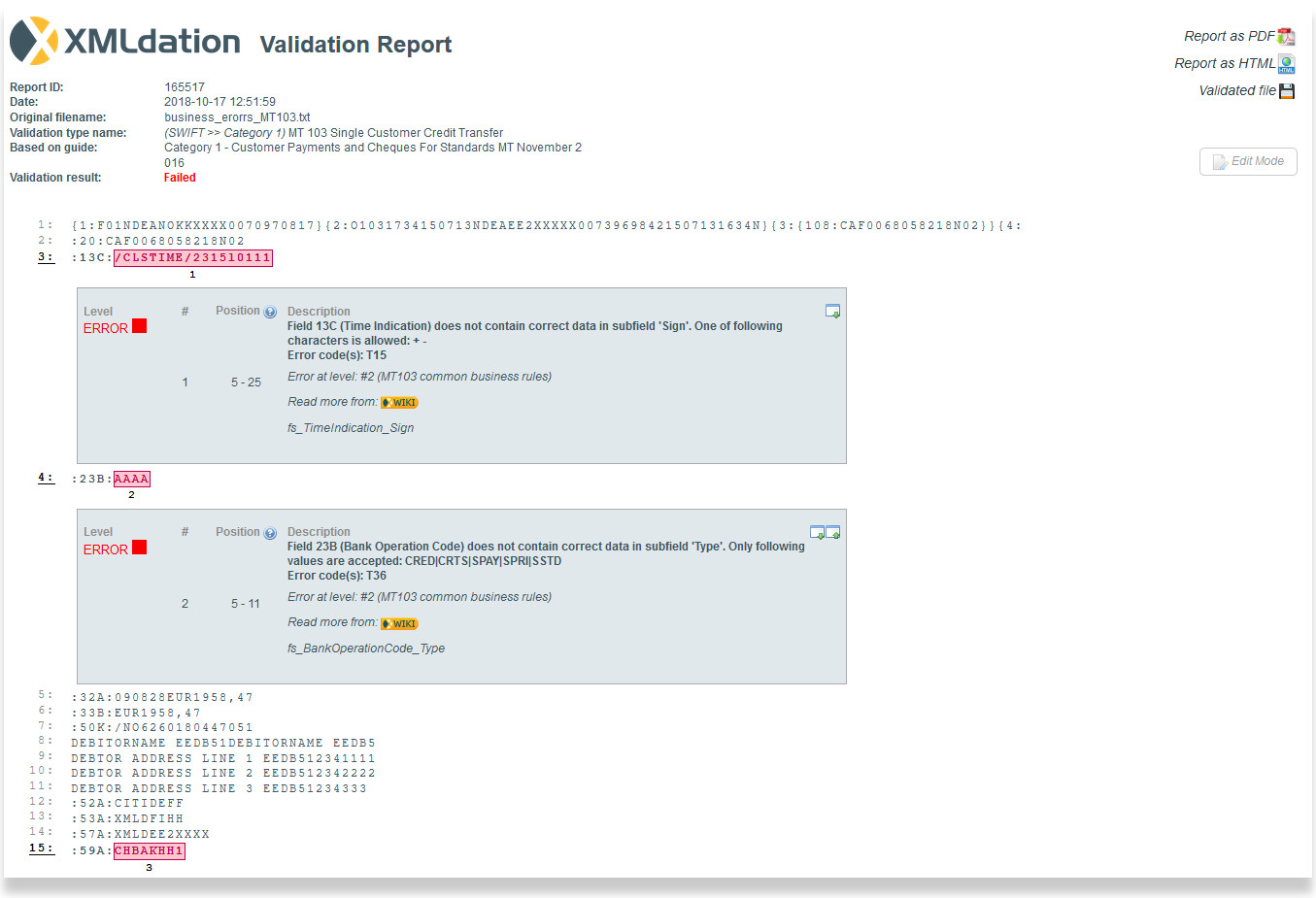

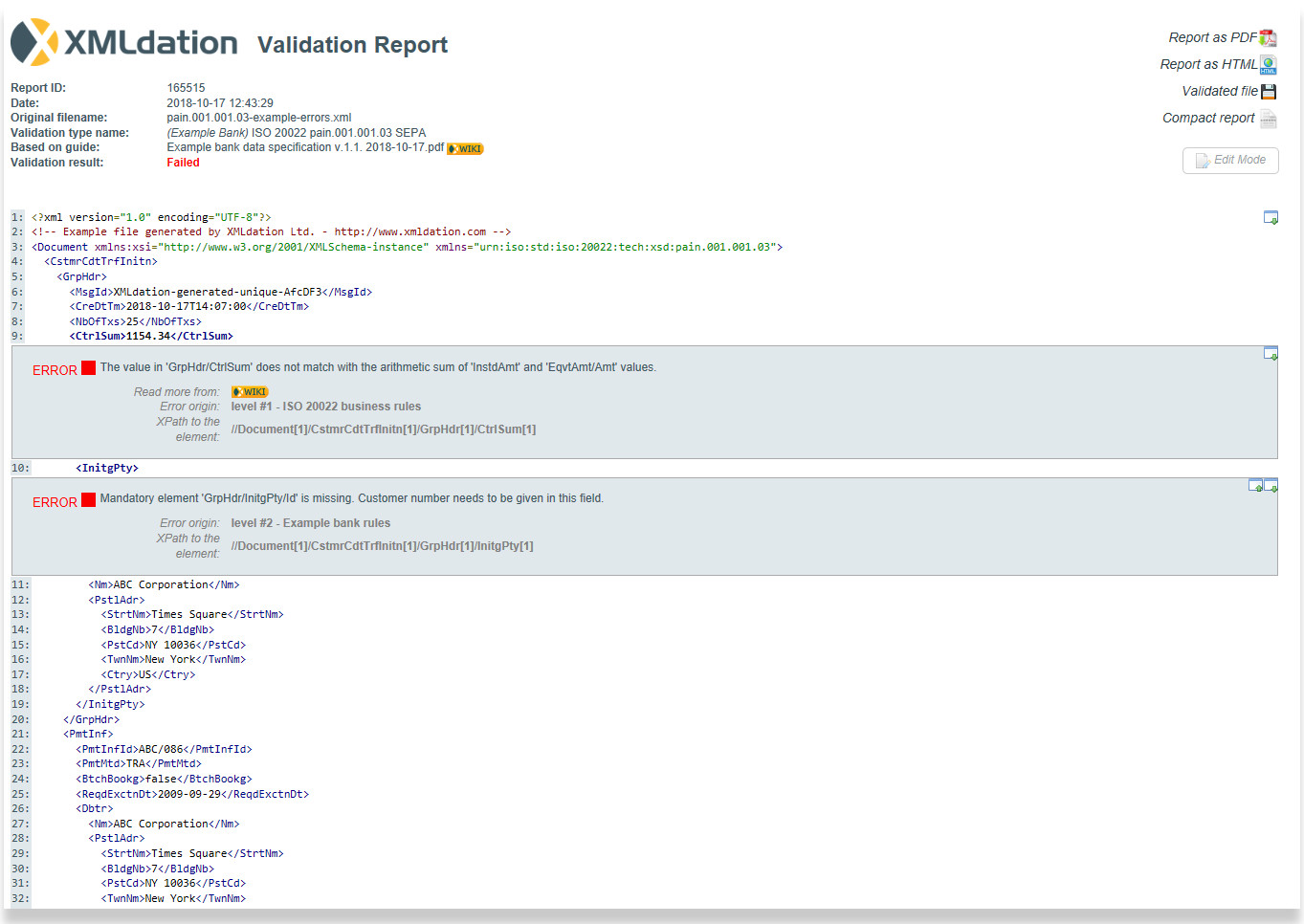

Validation report

The Validator produces high quality, easy to understand, validation reports that explain the errors in simple terms. The report includes the content of the validated file, and embeds error information at exactly the location of the error. The error information also includes links to Wiki pages, where more thorough explanations of issues with pictures and examples can be found. Check out an example of a wiki entry here.

The validated file can be edited in-place and re-validated for the purposes of trying out any fixes.

Validation reports can be downloaded in PDF format. For larger files, there is an option to create a ‘compact report’. This creates a report that contains only those sections of the file that contained errors, while retaining the correct line numbers from the original file.

Example 1: Validation Report for SWIFT MT103 Customer Credit Transfer

Example 2: Validation Report for ISO 20022 Pain.001 SEPA Credit Transfer

API Access

Payments files can also be validated via API. Documentation for the Validation API is available on our wiki. The validation service is scalable and can handle large amounts of data.

See a video demo of the Validator