Quick way to receive simulated payment status and account reports

When bank clients use payments products, they can expect to receive files from the bank providing information on status of payments and on accounts. These files can include notifications of accepts, rejects and returns from the bank as well as from the clearing systems.

Clients need to prepare their systems and processes to use these files. They need a quick and easy way to understand the format and content of the files. The best way to do this is to provide example files to the client that contains the client’s own data. One approach is to pull example files from the production system and send these to clients. But with this approach, it can be difficult to show the variety of files that the client may receive, especially for payments rejects.

The Simulator is used by bank clients to create realistic bank response files, for example payment status reports, based on their own payments data.

How the Simulator Works?

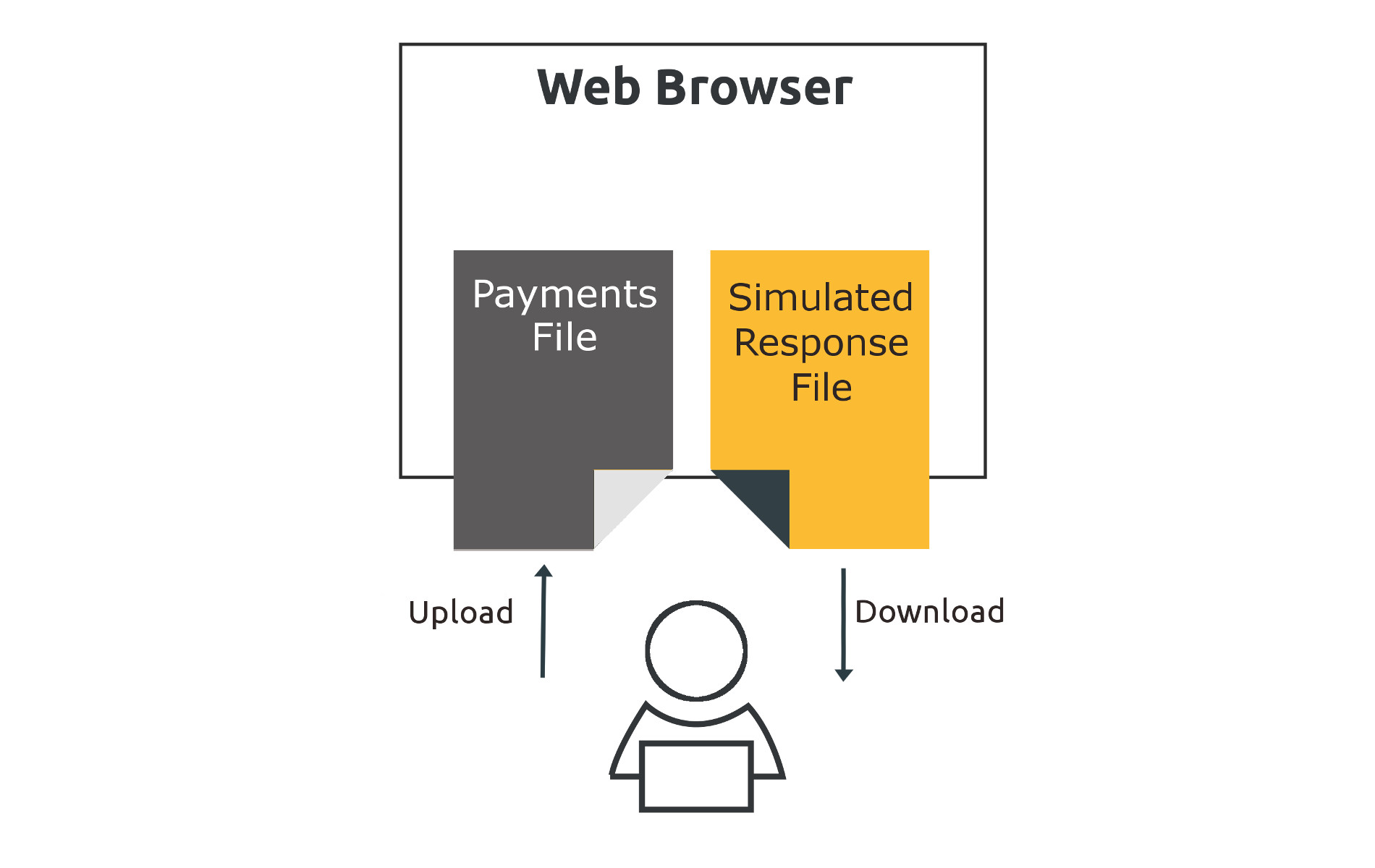

The Simulator is browser-based and requires no installation. The user logs into our Service, selects the type of simulated responses they want to receive, and uploads payments data on which the simulated responses will be based. The Simulator produces a variety of responses for view and download, covering the most important business scenarios.

File formats supported

The Simulator supports all file formats. Our clients already use the Simulator to create bank response files in a whole range of different file formats e.g.

- ISO 20022 XML

- SWIFT MT and MX

- Canadian EFT

- US ACH

The Simulator can also produce responses in multiple formats simultaneously. For example, it is possible to produce an account report in both ISO 20022 camt.053 and SWIFT MT 940 format. This makes it possible to see the differences and similarities between formats.

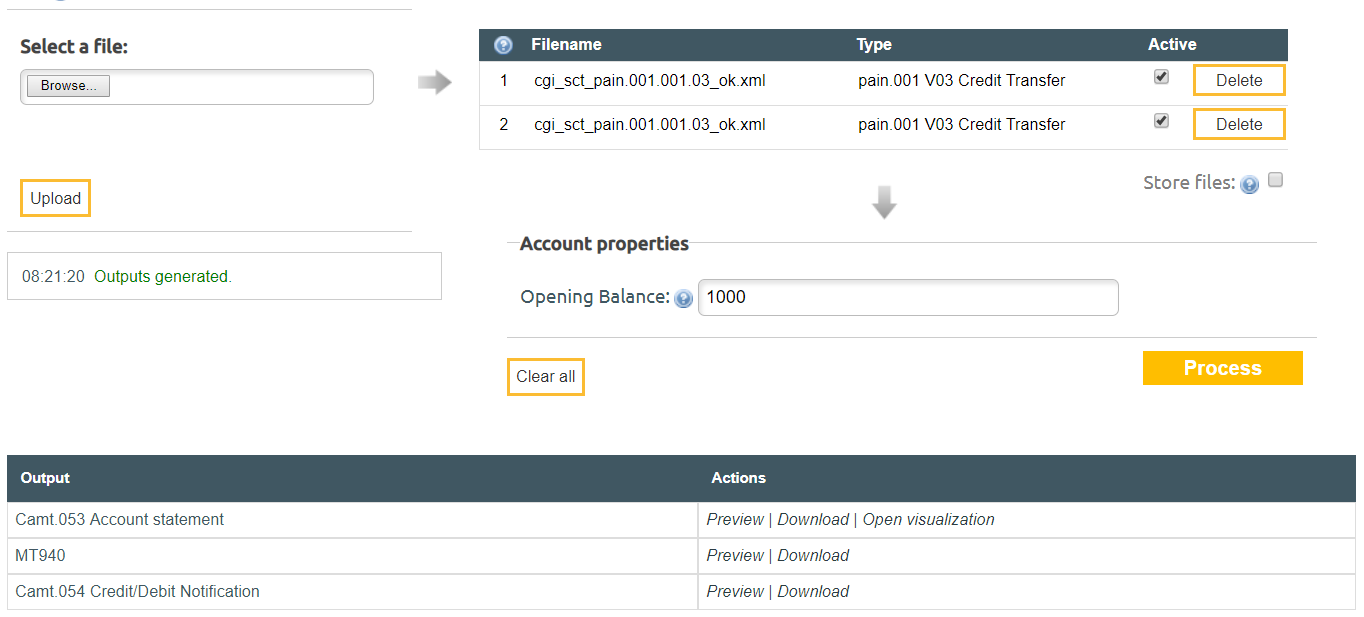

Example – Account Report simulation

The client selects the “Account Report” simulation scenario. They upload ISO 20022 pain.001 credit transfer files containing payment transactions, and choose an opening balance for the account. The simulator creates camt.053 and MT940 account statements, and a camt.054 credit/debit notification using the opening balance and the account and payment transaction information in the uploaded files.